At PBIB, our objective is to deliver the necessary coverage to shield your Swimming Pool Contractor enterprise from potential setbacks. As insurance brokers, we are not confined to a single insurance plan but select from a diverse range to optimally address your distinct insurance requirements. We advise the following coverages to safeguard your Swimming Pool Contractor business against losses, encompassing property destruction, personal harm, employee injuries, damage or loss to vehicles or tools & equipment, along with legal expenses and indemnity:

PBIB will typically use numerous insurance companies to quote your insurance to give you the best deal and coverage for your needs. Every policy has adjustable payment options, such as yearly or monthly payments.

At PBIB, our objective is to deliver the necessary coverage to shield your Swimming Pool Contractor enterprise from potential setbacks. As insurance brokers, we are not confined to a single insurance plan but select from a diverse range to optimally address your distinct insurance requirements. We advise the following coverages to safeguard your Swimming Pool Contractor business against losses, encompassing property destruction, personal harm, employee injuries, damage or loss to vehicles or tools & equipment, along with legal expenses and indemnity:

General Liability insurance may be mandatory for your Drywall Contractor license in your state or county of operation. PBIB offers full-service certificates during business hours, as well as 24/7 self-service certificates, which we refer to as "Insurance on your time".

General Liability for Swimming Pool Contractors can help you pay for:

We offer top-tier policies in the industry, ensuring protection for you and your employees in case of injuries or illnesses. Workers' compensation covers employee medical expenses and assists in recuperating lost wages, helping them return to work. In case of legal proceedings, workers' comp shields you as well. Choose us for a policy that safeguards both you and your workforce.

If you don't have employees but require a Workers' Compensation policy, we've got you covered with policies designed to protect you and meet your clients' expectations.

Your Swimming Pool Contractor license may necessitate Workers' Compensation coverage, depending on your state or county of operation. PBIB delivers full-service certificates Monday through Friday, as well as 24/7 self-service certificates, embodying our commitment to "Insurance Tailored to Your Schedule."

Workers' Compensation for Drywall Contractors can help you pay for:

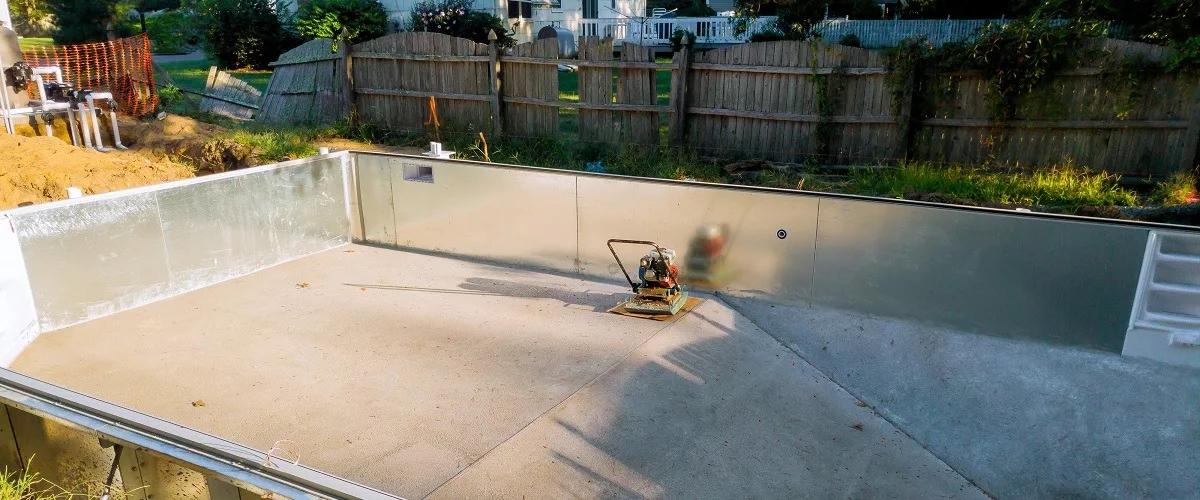

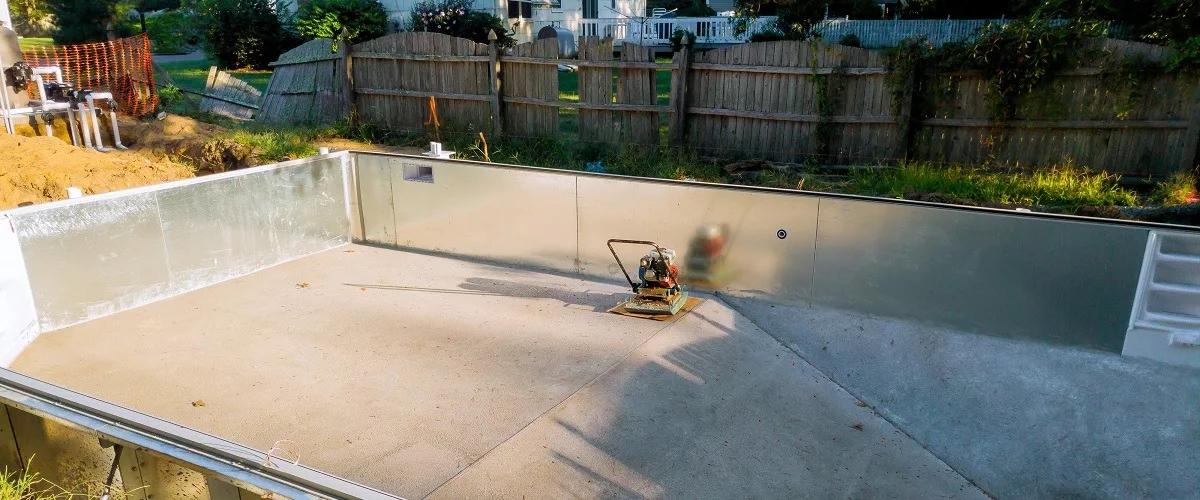

It’s impossible to run your Swimming Pool Contractors without your company vehicles to get you, your materials, and tools to the jobsite. We at PBIB know firsthand the value of your wheeled workforce and offer the insurance you need to be covered when trucks are damaged or stolen, we work to get you back working fast.

Commercial Auto insurance is an important insurance coverage for Swimming Pool Contractors, and a requirement for many projects, we provide full-service insurance certificates Monday through Friday to get you on the job, and 24/7 self-service certificates, this is what we call “Insurance on your time”.

Commercial Auto for Swimming Pool Contractors can help you pay for:

Insurance for Swimming Pool Contractors' tools and equipment is crafted to safeguard your valuable portable assets. Inland marine insurance, also referred to as tools and equipment coverage, defends your diligent investments against prevalent hazards such as theft and damage, whether on location, in storage, or during transit to and from your project site.

Tools & Equipment for Swimming Pool Contractors can help you pay for damaged or stolen:

In the competitive world of swimming pool construction, preserving a stellar reputation is vital for ongoing success. Professional Liability Insurance, also known as Errors & Omissions (E&O) coverage, is specifically designed to protect contractors against claims of negligence, errors, or omissions that may occur during their work.

As a Swimming Pool Contractor, you are responsible for delivering high-quality craftsmanship in compliance with industry standards. However, even the most skilled professionals can face unexpected challenges or make mistakes. In such cases, clients may hold you accountable for financial losses or damages resulting from your work. Without adequate protection, a single lawsuit could have a devastating impact on your business.

Investing in Professional Liability Insurance is a proactive measure that defends your financial stability and reputation within the industry.

Professional Liability Insurance can help your business with:

A contractor license bond is typically mandated by most states to secure or uphold your contractor permit. This license bond ensures that you will not breach any state regulations or abscond with a client's down payment.

License bond prices can start as low as $70, but the cost may increase based on factors such as personal credit, licensing history, and the contractor's classification.

We provide a comprehensive range of bonds (including performance & payment bonds, among others). Simply input your state and required bond type, or choose from a list, to receive an instant quote and complete the online binding process within minutes.

Phoenix is the capital and most populous city in the American state of Arizona, with 1,608,139 residents as of 2020. It is also the fifth-most populous city in the United States, the largest state capital by population, and the only state capital with a population of more than one million residents

WikipediaPhoenix is the anchor of the Phoenix metropolitan area, also known as the Valley of the Sun, which in turn is part of the Salt River Valley. The metropolitan area is the 11th largest by population in the United States, with approximately 4.85 million people as of 2020. Phoenix is the seat of Maricopa County and the largest city in the state at 517.9 square miles (1,341 km2), more than twice the size of Tucson and one of the largest cities in the United States.